Claims

- Home

- Claims

Unmatched Insurance Claim Services

Fire Damage

Fire damage refers to the physical damage to a property because of burning. This damage may either be directly caused by the flames or could occur due to smoke and other corrosive substances emitted by the fire.

Water Damage

A water damage clause is a provision in a property insurance contract that details whether the insurer covers water damage to the property, and if so, under which circumstances and for how much. Usually, most homeowners and renter policies include such clauses.

Wind Damage

Windstorm insurance is a subset classified as a casualty-property insurance that provides protection to persons and property against the damages of windstorms. This policy is a supplementary benefit and may be added to the main homeowners’ policy for an additional premium.

Hurricane Damage

Property loss and damage due to natural disaster called a hurricane. Coverage for damage from hurricane winds might be included in a homeowner's policy. Water damage caused by same might not be covered.

Commercial Damage

A commercial property policy is an insurance policy that covers the buildings and contents of the buildings for a business.

Vandalism Damage

Vandalism and malicious mischief (VMM) insurance is a type of property insurance coverage that indemnifies or compensates the insured for losses arising from acts of vandalism

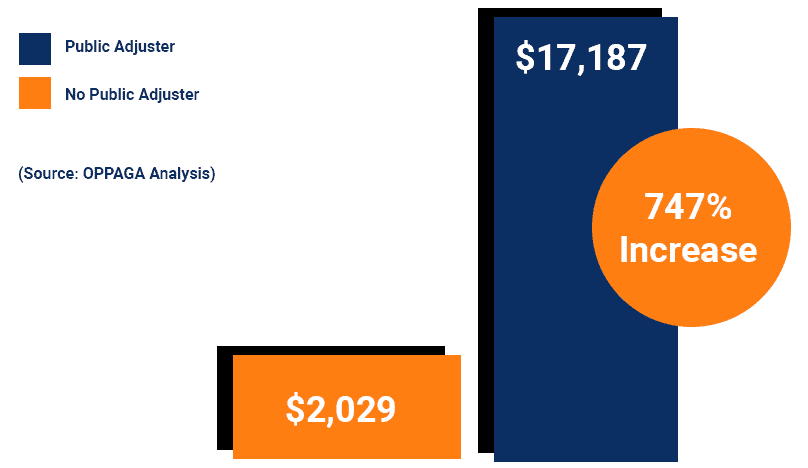

It Pays to Hire an Adjuster